Perspective on factors influencing market sentiment

Review the latest Weekly Headings by CIO Larry Adam.

Key takeaways

- Concerns about a sweeping “Sell America” trade are exaggerated

- The US dollar is still the world’s dominant reserve currency

- Recent tech underperformance should prove short-lived

With rising geopolitical tensions, sharp market swings and Congress at odds over Department of Homeland Security funding – likely to cause a brief government shutdown – there’s no shortage of factors influencing sentiment. Here, we address some of the most prominent headlines shaping sentiment and offer our perspective.

Narrative: The reemergence of the “Sell America” trade – Escalating geopolitical tensions and renewed tariff threats over the last few weeks have sparked concerns that investors may be rotating out of US assets.

Our perspective: Despite headlines hinting at fading demand for US assets, the idea of a broad “Sell America” trend is overstated. While renewed tariff threats and strains in the transatlantic alliance have added fresh volatility, these appear to be short-term noise rather than signs of a structural shift. Market behavior after the April 2025 tariff tantrum points to resilience, not retreat. The latest Treasury International Capital (TIC) data shows that foreign holdings of US equities remain on track to rise $2.8 trillion in 2025 and foreign ownership of Treasuries has climbed to a record $9.4 trillion in November. Treasury auctions also continue to show healthy demand from US and foreign buyers. Taken together, the data reinforces our view that concerns about a sweeping “Sell America” trade are greatly exaggerated.

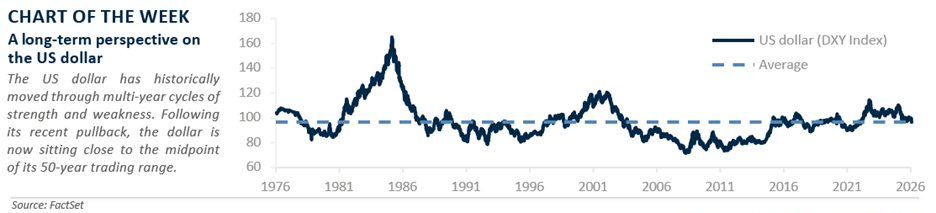

Narrative: The dollar’s decline and gold’s rally signal rising debasement anxiety – After months of stability, the renewed downturn in the US dollar, paired with gold’s rapid ascent, has amplified concerns about the end of dollar dominance.

Our perspective: Calls for the demise of the US dollar are nothing new. Dollar bears often point to its declining share of global reserves – now at roughly 57%, down from roughly 64% in 2017 – and tie this to rising policy unpredictability. Yes, the dollar slipped roughly 9% last year and is down roughly 2% year-to-date amid renewed uncertainty, but context matters. First, despite recurring headlines, the dollar’s share of global reserves has been remarkably steady, with Federal Reserve data showing no meaningful shift away from the dollar after the 2022 Russia sanctions. Second, claims that gold has “replaced” the dollar as the preferred reserve asset are overstated: gold’s rising share largely reflects its 200%+ price gain since 2019, not broad reserve reallocations. Third, the US dollar remains the dominant currency in global transactions – accounting for just over 50% of all SWIFT flows – underscoring its central role in global finance. While its market value can move in the short run, history shows the dollar has been remarkably stable, trading near the midpoint of its 50-year range. After an unusually strong period of performance, it is simply returning to pre-COVID levels. We expect the dollar to remain broadly stable in 2026.

Narrative: Depressed confidence signals softer spending ahead – Consumer confidence fell to its lowest level since 2014 this week, posting the largest monthly drop since Aug 2021. This raised concerns that weakening sentiment could weigh on consumer spending ahead.

Our perspective: In recent years, consumers have essentially been saying one thing and doing another. Confidence has been depressed – sitting below its 30-year average for 11 straight months – yet spending has remained strong, running above 5% year over year the entire time. The latest drop in confidence and the low 3.5% savings rate (its weakest since October 2022) raise understandable concerns, but we still don’t expect a meaningful pullback in spending. Why? First, while the labor market has been soft, we expect hiring to improve in 2026 relative to 2025, giving households more income support. Second, tax-bill changes should lift the average refund by roughly $1,000, and rising equity markets have boosted household net worth, offering a one-time lift to spending. And finally, major events such as the World Cup should help fuel tourism-related demand. Together, these dynamics support our decision to upgrade the consumer discretionary sector heading into the year.

Narrative: Tech-related leadership has come to an end – With tech-related sectors off to their worst start to a year since 2000, investors are worried the group will lag as market leadership broadens.

Our perspective: The technology sector has gotten off to a weak start to the year (-0.3%), but the story beneath the surface is anything but uniform: semiconductors are up 8% while software is down 12%. Even with this dispersion, 4Q25 earnings across tech-related names have been strong, with management teams repeatedly noting that AI-chip demand continues to outpace supply, supporting a robust outlook for AI capital expenditure and infrastructure in the year ahead. That said, post-earnings reactions show investors are becoming more discerning, rewarding companies that balance future growth investment with margin discipline and free-cash-flow strength. Overall, we remain overweight the tech space. Why? Superior earnings growth – nearly double the broader market – along with sustained AI investment and valuations at their lowest level vs. the S&P 500 since 2015 continue to support the group. But selectivity will be essential.

*MAGMAN represents a composite of Microsoft, Apple, Google, Meta, Amazon, Nvidia. The foregoing is not a recommendation to buy or sell MAGMAN stocks.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success.

Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.

The S&P 500 Total Return Index: The index is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 7.8 trillion benchmarked to the index, with index assets comprising approximately USD 2.2 trillion of this total. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization.